Copy trading

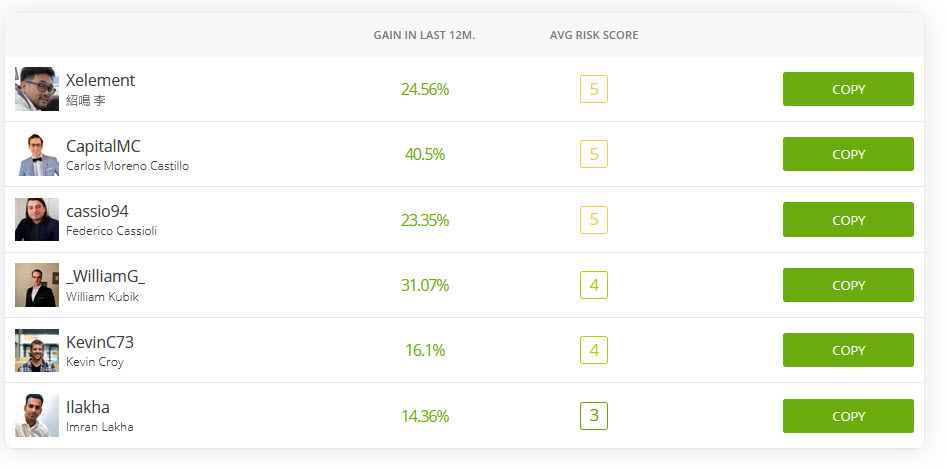

Today, many trading platforms online offer copy trading. This makes it possible for you to let the program automatically copy another trader´s trading actions. On many platforms, you can also elect to let other traders copy your trades, provided that you fulfil the requirements. Many copy trading platforms give various benefits to traders who gain a large enough following on the platform. They might for instance be given cash bonuses and better spreads.

Examples of actions that can be copied:

- Opening a position

- Closing a position

- Assigning stop loss

- Assining take profit

Copy an entire portfolio

In addition to copy another trader´s actions step-by-step in real time, there are trading platforms that will allow you to copy entire portfolios.

Liquidity

Copy trading typically takes place on markets characterized by very high liquidity. If the liquidity is not very high, it can prove difficult to quickly copy another trader´s action.

Example: The master trader decides to close a position and sells 100 shares in Company A for $10.00 per share. When the program tries to copy this action, there isn´t enough market interest to absorb another 100 shares in Copany A at this price level. When the shares finaly sell, it is for $9.50 per share.

One example of a market with very high liquidity is the forex market, if you trade in any of the major currency pairs, such as EUR/USD, USD/JPY, GBP/USD, and USD/CHF.

Can I use leverage for copy trading?

Yes, with some brokers you can. Terms and conditions vary.

Using leverage means borrowing money from the broker to carry out trades. It adds another element of risk, since you can end up losing money you never owned. Even if you follow a highly successful trader, there are never any guarantees.

One of the reasons why traders are fond of using leverage when doing copy trading is that it can help them trade on the same level as the master trader they wish to copy. You might have a small bankroll, but leverage can allow you to open big positions.

Background

Systems for automatic replication of trade actions began to appear online in the mid-2000s. Copy trading and mirror trading developed from automated trading / algorithmic trading.

Academic research

- A 2012 MIT study found that traders on eToro who used copied an eToro Suggested Investor fared 6-10% better than traders who traded manually, and 4% better than traders who followed random investors at the platform. The study was directed by Dr. Yaniv Altshuler.

- In 2014, a financial trading study showed that copied trades are more likely to produce positive returns compared to standard trades. The study also showed that return on investment on profitable copy trades were lower than return on investment on profitable standard trades. The study was carried out by Mauro Martion (of IBM Research), Yaniv Altshuler (MIT), Yang-Yu Liu, Jose C. Nacher and Tomoshiro Ochiai.

- A 2018 study showed that losses were usually higher for copied trades (compared to standard trades) in the event of negative returns. The study was carried out by Matthias Pelster (Paderborn University) and Annette Hofmann (St. John´s University).